If you’ve ever tried trading crypto options or other derivatives, you might already know that trading fees can sometimes feel like a silent drain on your profits. You enter trades carefully, make the right calls, and yet by the time all the costs are deducted, your net returns look slimmer than expected.

That’s why one of the most overlooked aspects of trading success isn’t just strategy or timing – it’s choosing a platform where fees don’t eat away at your hard-earned gains.

This is where crypto trading platforms like Delta Exchange set themselves apart. By offering one of the lowest fee structures in the crypto options market, Delta lets traders – whether beginners or professionals – to maximise profits, experiment with new strategies, and build consistency over the long run.

In this article, we’ll review how Delta’s low fees make a difference in everyday trading and why it matters for anyone looking to grow in the crypto options sector.

Why Trading Fees Can Make or Break Profitability

When you’re trading frequently, every percentage point matters. Even a seemingly tiny difference in fees has a compounding effect over time.

Consider this example: Let’s say you’re trading BTC options every day. A fee variation of just 0.05% might look trivial at first glance. But across dozens of trades in a month, that difference can add up to a lot that’s slipping through your fingers. For institutions or high-volume traders, the loss is even more significant.

Another common frustration is hidden costs. On many exchanges, you don’t just pay trading fees – you also lose on wide spreads, non-transparent liquidation fees, or surprise holding costs. All of these eat into your bottom line.

That’s why fee transparency is so important, and why Delta Exchange works hard to keep things simple and affordable.

What Makes Delta Exchange Different?

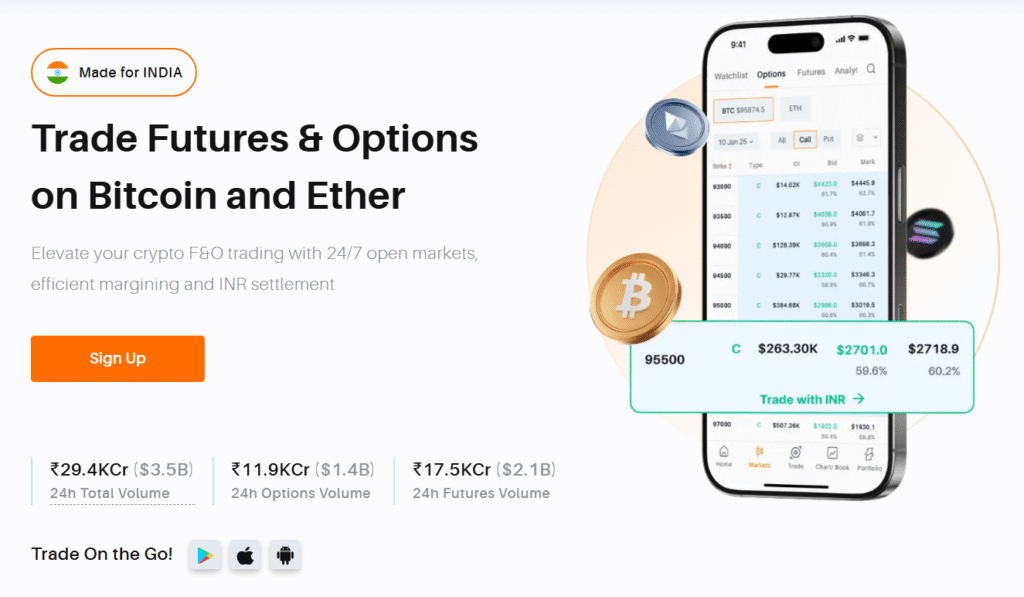

Delta Exchange’s low-cost fee structure makes crypto options trading hassle-free

Delta Exchange has built its platform around one principle: keeping fees low and transparent so traders keep more of their profits. Here’s how their fee structure works:

- Trading fee: A flat 0.015% for both maker and taker orders.

- Lot sizes: 1 lot = 0.001 BTC for Bitcoin options, 0.01 ETH for Ethereum options.

- Liquidation fees: Fixed as a percentage of premium or notional size, with clear disclosure upfront.

- Other charges: 0% deposit and withdrawal fees, standard 18% GST on trading fees, and settlement fees only where applicable.

What this means is that whether you’re testing crypto trading strategies with small positions or executing higher-volume trades, costs remain consistently low. You don’t have to second-guess what portion of your gains will be lost to unexpected platform charges.

How Lower Fees Boost Your Earnings

The impact of lower fees isn’t abstract – it directly affects how much you take home each time you trade. Here’s why Delta’s low fees matter:

- Higher returns per trade: Less money spent on fees means more of your profit stays in your wallet.

- Freedom to experiment: You can test advanced strategies like spreads, hedging, or scalping without worrying that costs will wipe out small wins.

- Better for active traders: If you’re trading frequently, the savings from low fees accumulate into substantial long-term benefits.

- Accessibility for beginners: Lower entry costs make it easier for new traders to start small and scale gradually.

By paying less in trading costs, you give yourself more flexibility and room to grow as a trader. Delta makes this possible without compromising on platform quality or features.

Features that Support Crypto Options Traders Beyond Low Fees

Trade crypto options smoothly on Delta Exchange

Lower costs are important, but Delta Exchange doesn’t stop there. The platform brings together multiple features to ensure crypto options trading is efficient, safe, and user-focused.

Some standout features include:

- INR-based trading: A big advantage for Indian traders is the ability to directly deposit and withdraw in INR without incurring currency conversion losses.

- Demo trading mode: Perfect for beginners, this allows you to test strategies in a safe environment before risking real capital.

- Payoff charts: These give you a clear breakdown of your potential profit and loss before executing a trade.

- Small lot sizes: BTC contracts start as low as ₹5000 and ETH options at ₹2500, making crypto derivatives accessible without big capital requirements.

- Multiple products under one platform: From trading BTC and ETH options to exploring futures, perpetuals, and trackers, you can trade a wide range of instruments within a single account.

- Automation support: Algo trading bots and advanced analytical tools make it easier for experienced traders to scale strategies with precision.

Trust and Transparency Matter

In crypto trading, trust is everything. Traders want to know that their funds are secure, fees won’t change overnight, and liquidity won’t dry up when they need it most.

Delta Exchange meets this demand by being registered under the Financial Intelligence Unit of India and by building a reputation as a reliable, growth-focused derivatives platform. With daily volumes crossing $4.4 billion, its liquidity and execution speed give confidence to both casual traders and high-frequency players.

The combination of regulatory compliance, transparency, and scale makes it more than just another Indian crypto exchange – it becomes a reliable go-to crypto options trading platform.

Final Thoughts

Crypto options trading success isn’t just about making the right market calls. It’s about ensuring that the profits you generate actually stay with you. That’s why trading fees play such a pivotal role in shaping long-term outcomes.

You can get started on Delta Exchange by signing up at www.delta.exchange, adding funds in INR, and exploring crypto options. If you prefer trading on the move, the Delta Exchange app makes it simple to access crypto derivatives anytime.

For more details, connect with the Delta Exchange community on X.

Disclaimer: Crypto options trading involves high market volatility and carries risk. Kindly do your own research and consult professionals before making crypto investment-related decisions.

I am highly experienced and well-respected in the field of cryptocurrency. I have been writing in this niche for over 5 years and have become an expert in the field. My work has been featured in many major publications, including Forbes, CoinDesk, and Bitcoin Magazine. I am a regular speaker at crypto conferences and meetups. I am the founder of Crypto Media Hub, a company that provides consulting and content marketing services to blockchain and cryptocurrency startups.